Hey buddy, Glad to see you here! Welcome to Thursday, 21st December 2023’s Matters that Matter. Happy Reading!

1. Explainer on the Telecommunication Bill 2023

On Wednesday, the Lok Sabha passed the Telecommunication Bill 2023. It will replace the Indian Telegraph Act 1885, The Wireless Telegraphy Act 1933, and the Telegraph Wires (Unlawful Possession) Act 1950, some of which date to the colonial era. The new Bill proposes significant and far-reaching changes in the regulatory architecture governing the telecom sector in India.

It allows for the administrative allocation of spectrum for satellite broadband services- Spectrum assignment is a contentious issue that has generated much debate. Since the Supreme Court's ruling in 2012, spectrum has been auctioned. In the case of spectrum for satellite broadband, the Bill paves the way for administrative allocation on the grounds that it would create space for more players, particularly the start-up ecosystem in the space sector, and have a moderating influence on prices.

It has also sought to simplify the licensing regime- The Bill has also sought to merge many of the licenses, registrations and permissions into a single authorization process. This will ease the regulatory burden.

It has kept communication (like WhatsApp) and OTT services outside the ambit of telecom regulations- The distinction between the network layer and the application layer (in which OTTs lie) has been maintained.

The Bill also allows the Central government to take over control and management of telecommunication services in the interest of national security or in the event of a war, and for governments, both central and state, to take temporary possession of telecom services or networks in case of a public emergency.

2. What led to India’s fast GDP growth and Sensex surge?

The beginning of the current financial year, there were very few takers for RBI's forecast of 6.5% GDP growth. Most professional economists believed it would be slower. As the calendar year ends, India's growth has beaten street expectations.

The Q2 growth rate was powered by solid industrial growth - especially manufacturing, which grew by almost 14% over the same quarter of the last financial year. However, what is unclear is (beyond the obvious low-base effect) what led to this massive jump in manufacturing output.

The Q2 numbers came on November 30, and on December 3, the BJP won elections handsomely in three heartland states. The stock market has been on a high ever since. Foreign investors are buying again, and domestic retail investors too, remain deeply invested in the growth story.

However, the data also show that growth in the consumption levels of the average Indian is struggling. And apart from the broad sluggishness, there is a widening urban-rural divide in the consumption recovery.

So, is the Indian economy, which was struggling before the pandemic, now completely out of the slowdown phase? The answers are mostly yes. But there are some caveats.

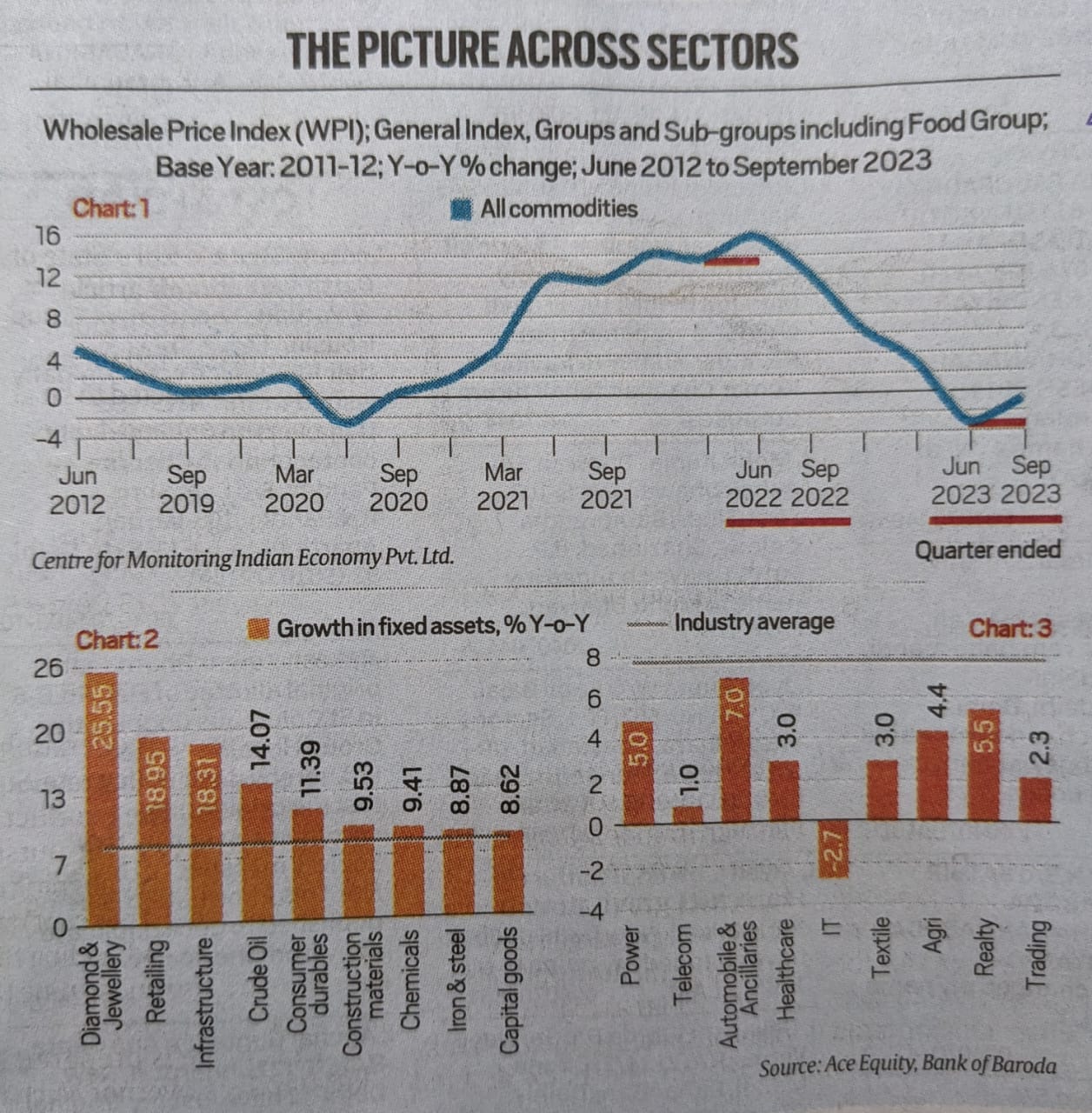

K-shaped industrial recovery

While, on aggregate, the economy seems to have recovered, there are wide gaps within the country. A large population continues to face unemployment, stagnant incomes (or even declining real wages) and broad-based economic distress, while a small but significant enough number have seen consumption levels rise higher than pre-pandemic levels. This 'K-shaped recovery in consumption also shows up in a K-shaped recovery of industries

Jump in Q2 factory output

The gross value added (GVA) in manufacturing grew by almost 14% in Q2.

GVA is a way of counting returns to different factors of production -labor, capital, entrepreneurship, and, to a very small level, rent.

Since the operating profits of industries rose, their GVA showed a sharp increase too, in spite of a contraction in net sales in Q2 FY24. The reason being even though companies did not sell more goods, they ended up making more profits because the prices of their raw materials plummeted.

Rise in the Sensex

The sharp increase in company profits (which boosted the GDP calculation) was noted by investors as improved company earnings. That led investors to buy those stocks, and those firms' share prices increased in consequence. The rise in stock prices lifted the market indices.

'K' in industrial recovery

Two aspects of India's K-shaped consumption recovery are to be noted:

The gap between urban and rural demand.

Even within urban demand, the shift is towards more premium products.

Consumption demand is the biggest engine of India's GDP growth. Similarly, on the investment side, which is the second-biggest engine of GDP growth, most firms that are doing well are benefiting from the government's capital expenditure push. Thus, infrastructure and banks are growing in terms of both profits and net sales, while textiles are still struggling on both counts.

Profits and investment

Do higher profits mean companies are starting to invest more? It has been possibly the most important economic policy goal of the government to "crowd in the private sector to start the virtuous cycle of investments and ensure the sustainability of economic growth.

It was seen that higher profits and rising capacity utilization levels seem to be incentivizing companies in at least some sectors to boost productive capacity. However, this growth is unevenly distributed among companies belonging to different economic sectors.

Sectors that did better than the average were either those that catered to "premium" consumption demand, such as gems and jewellery-or those that benefited from the government's capex push- such as infrastructure and construction materials

There are three main takeaways:

Companies saw their profits soar despite stagnant (or contracting) net sales. This surge in profits is what is leading to a surge in stock prices.

The corporate performance as well as the boost to private capital formation, has been uneven- almost in line with the K-shaped consumption recovery.

The data show that at an aggregate level, India Inc. is working at a higher level of capacity utilization than before the pandemic. This bodes well for the future.

3. Lok Sabha nods for the 3 new criminal law bills

From expanding detention in police custody from the current 15-day limit to up to 90 days, bringing terror, corruption and organized crime under ordinary legislation for the first time to decriminalizing homosexuality and adultery, the Lok Sabha Wednesday passed three key Bills-Bharatiya Nyaya (Second) Sanhita, 2023; the Bharatiya Nagarik Suraksha (Second) Sanhita, 2023; and the Bharatiya Sakshya (Second) Bill, 2023-to completely overhaul the country's criminal laws.

Piloting the Bills, Union Home Minister Amit Shah said these are aimed at indigenizing laws originally enacted by the British.

- References and Excerpts from The Indian Express

If you read till the end, I am so proud of you for being a responsible and informed citizen of the world! Don’t forget to pass the baton to your friends by sharing this article.

Your suggestions are invaluable and would help Matters that Matter to improve and deliver to the community better. So, feel free to reach out!

Until then, sending lots of best wishes and love <3